Our Shipley Energy Commercial Solutions Team is excited to share with you the September Energy Market Update to keep you informed on trends, weather, and other factors impacting the energy market.

Energy markets at home and abroad have experienced their fair share of tumultuousness. In September, we saw several factors that contributed to the volatility. Here’s Will Muller, Sr. Business Development Manager, with a quick take on what has transpired this past month.

The October 2022 Nymex contract continued the trend of volatile, with a settlement price of $6.868/mmbtu–the lowest since July 2022. Trading ranged between the high $9’s to mid-$6’s throughout the month.

Other factors influencing trading is apprehension over energy supply heading into winter for much of the world, and particularly in Europe. The ongoing war between Russia and Ukraine has heightened these fears with natural gas supplies from Russia being cut and disrupted continuously.

Concerns over the state of the global economy and rampant inflation could also be responsible for recent sell offs at the Nymex.

Several factors impacting the natural gas markets currently:

With Nymex natural gas markets retreating down to some of the lowest levels since July 2022, now is a great opportunity to reach out to your account manager for a refresh of natural gas rates. Prices are lower all down the curve, so options anywhere from 6-36 months may now provide the opportunity to lock in.

Other options include Basis Only or Nymex Lock deals to separate the two elements of your natural gas price to look for potential value vs standard Fixed pricing. Ask your Account Manager for details.

October 2022 Natural Gas NYMEX Settlement Price: $6.868/mmbtu

Last month: September 2022 Natural Gas NYMEX Settlement Price: $9.353/mmbtu

Last year: October 2021 Natural Gas NYMEX Settlement Price: $5.841/mmbtu

Natural gas prices have recently come down from historic highs. The coming winter months are down to the high-$6 to low-$7 range, and most months after March 2023 are in the $4’s and $5’s.

As natural gas is the largest feedstock for electricity production, and most volatile in price, this activity has pulled electricity prices down as well.

The Calendar 2023 power price in PPL, which opened the month at $0.0920/kWh, hit its recent high of $0.0927/kWh on September 14, and is currently all the way down to $0.0779/kWh – a drop of 15.9%.

Colder-than-expected winter weather, increased domestic electricity and/or natural gas usage, decreased natural gas production, or faster-than-anticipated expansion of LNG exports are all points of risk – all would drive power prices up in a hurry.

Utility standard offers are being pulled up by the continued high prices, with increases of as much as 4 cents/kWh forecasted for several Ohio and Pennsylvania utilities.

The only true bearish price factor that we have identified is the possibility of a recession – but with natural gas prices impacted by high levels of LNG exports, it would take a mild winter and a true worldwide recession to provide substantive price drops.

Increased natural gas usage for electricity generation has kept storage levels well below both last year and the 5-year average – cold weather raises fears about winter shortfalls and pushes US power prices up.

This is a prime buying opportunity – do not let your head hit the pillow tonight without making sure your electricity is hedged through 2024, at least. If you have lingering concerns about signing too early and missing out on a better price in the spring, opt for a 24-month contract to leave a blend-and-extend option available.

Energy buying in this market is not a “do-it-yourself” prospect – make sure you are getting expert advice from a trusted supplier or an advisor that will protect your best interests.

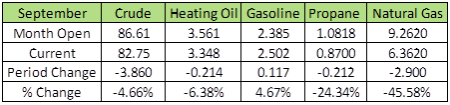

Pennsylvania, Northeast and Midwest regional distillate and gasoline supply disruptions continue to hamper cash markets. As the weather starts to turn cooler, the effect of very low distillate and gasoline stocks will be felt more quickly. We see this represented at the terminal rack level as overall futures prices continue to move lower, but rack basis widens and gets stronger.

U.S. distillate exports continue to be a risk as prices abroad are much higher, pulling diesel out of the U.S. If stocks get to threateningly low levels, Energy Secretary Jennifer Granholm may implement an export ban.

We continue to stress securing physical supplies with your account manager heading into cooler weather.

Disclaimer: The market update is intended solely for informational purposes only. Shipley Energy Company does not warrant or attest to its accuracy. All actions and judgments taken in response to this report are the recipient’s sole responsibility. Shipley Energy Company shall not be liable for any direct, indirect, incidental, consequential, special, or exemplary damages or lost profit resulting from these market updates.